Welcome to the dynamic world of commercial insurance! In this article, we will be exploring the ins and outs of insuring your business in the state of California. Whether you’re a small restaurant owner looking for protection or a business with a fleet of vehicles, understanding commercial insurance is key to safeguarding your success.

Navigating the complexities of commercial insurance can be a daunting task, but fear not. We are here to provide you with a comprehensive guide on how to secure the right coverage for your specific needs. For those operating in the vibrant Californian food scene, we will delve into the intricacies of restaurant insurance. Meanwhile, if your business relies on a fleet of vehicles to keep operations running smoothly, we will also delve into the world of commercial auto insurance, ensuring that you can confidently protect your assets on the ever-busy California roads.

So, get ready to unravel the intricacies of commercial insurance in California as we equip you with the knowledge and guidance needed to insure your success. Whether it’s protecting your restaurant or vehicles, we’ve got you covered!

Types of Commercial Insurance in California

California business owners understand the importance of protecting their investments and assets. Commercial insurance provides the necessary coverage to mitigate the risks associated with running a business in the Golden State. In this section, we will explore the various types of commercial insurance available in California.

General Liability Insurance: General liability insurance is a fundamental type of coverage for businesses in California. It protects against claims of bodily injury, property damage, and personal injury. This insurance provides compensation for legal expenses, medical bills, and settlements that may arise from these types of claims.

Property Insurance: Property insurance is crucial for businesses that own or lease property in California. This type of insurance covers your commercial property against damage or loss caused by fire, theft, vandalism, natural disasters, and other specified perils. It provides financial security to repair or replace damaged property, ensuring your business can continue operating smoothly.

Commercial Auto Insurance: If your California business relies on vehicles for operations, commercial auto insurance is essential. This coverage protects your commercial vehicles and drivers in the event of accidents, theft, or damage. It provides compensation for property damage, bodily injury, medical expenses, and legal costs resulting from auto-related incidents.

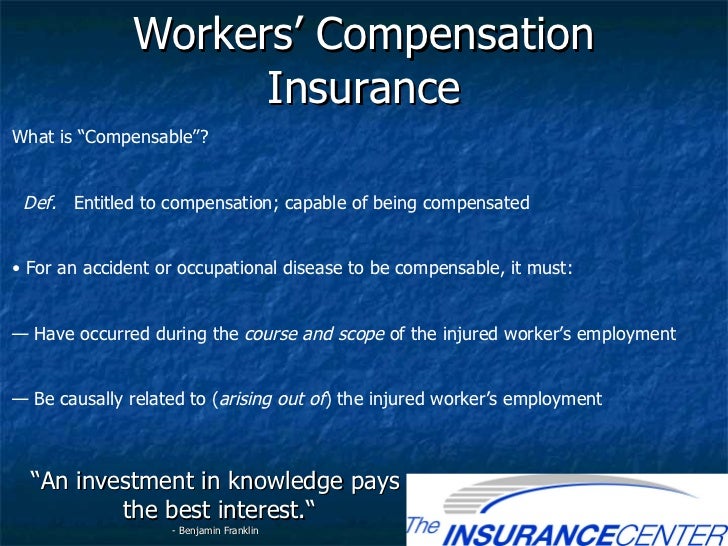

Remember, these are just a few examples of the types of commercial insurance available in California. Other important coverage options include workers’ compensation insurance, professional liability insurance, and cyber liability insurance. It is essential to assess your business’s unique needs and consult with professional insurance agents to determine the most suitable coverage for your California-based enterprise.

A Comprehensive Guide to Restaurant Insurance in California

Running a restaurant in California can be a thrilling venture, but it also comes with its fair share of risks and uncertainties. To protect your business and ensure its success, having the right insurance coverage is crucial. In this guide, we will take a closer look at restaurant insurance in California and provide you with valuable insights to help you navigate the complex world of commercial insurance.

- Understanding the Basics

When it comes to restaurant insurance in California, there are several key policies that every restaurateur should consider. One important coverage is general liability insurance, which protects your business from third-party claims of bodily injury, property damage, or personal injury. This insurance can come in handy if a customer slips and falls on your premises or if a delivery person accidentally damages your property.

Another essential policy to consider is property insurance, which safeguards your restaurant’s physical assets, including the building itself, equipment, and inventory. Be sure to carefully assess the value of your property to ensure adequate coverage. Additionally, business interruption insurance is worth considering, as it helps cover the income lost during unexpected closures due to covered events such as fire or natural disasters.

- Specialized Coverages for Restaurants

The unique risks faced by restaurants require specialized insurance coverages. One such coverage is equipment breakdown insurance, which provides financial protection in the event of equipment failures that may disrupt your operations. From ovens and refrigerators to HVAC systems, this coverage ensures that you can quickly repair or replace crucial equipment without bearing the full financial burden.

Food contamination or spoilage can also be a significant concern for restaurants. In such cases, food spoilage insurance can be extremely valuable. It covers the cost of replacing spoiled food due to power outages, equipment malfunctions, or other covered causes. Additionally, liquor liability insurance is a must if your restaurant serves alcoholic beverages. It offers protection against potential claims arising from the actions of an intoxicated customer.

- Choosing the Right Insurance Provider

Workers Compensation Insurance in California

When selecting an insurance provider for your restaurant in California, it’s essential to consider their experience working with the food service industry. Look for insurers who understand the unique challenges and risks faced by restaurants. Additionally, compare coverage options, policy limits, deductibles, and premiums from multiple providers to ensure you’re getting the best value for your money.

Remember that every restaurant has its own set of risks, so take the time to assess your specific needs before making a decision. Work closely with an experienced insurance agent who can help tailor a policy that meets your requirements and provides adequate coverage for your restaurant in the vibrant culinary landscape of California.

By understanding the basics, exploring specialized coverages, and selecting the right insurance provider, you can navigate the realm of restaurant insurance in California with confidence. Protecting your business with comprehensive insurance coverage will not only give you peace of mind but also ensure that your restaurant can thrive and succeed in the face of unexpected challenges.

Navigating Commercial Auto Insurance in California

When it comes to commercial auto insurance in California, there are a few key factors to consider. Whether you own a fleet of vehicles for your business or use a single truck for deliveries, having the right insurance coverage is crucial for protecting your assets and ensuring peace of mind on the road.

Firstly, it’s important to understand the specific requirements for commercial auto insurance in California. The state mandates that all vehicles used for business purposes must carry liability insurance coverage. This coverage helps protect your company from any potential financial loss in the event of an accident that causes property damage or bodily injury.

Beyond liability coverage, it’s also wise to consider additional types of insurance that can provide further protection. For instance, comprehensive coverage can help with expenses related to non-collision incidents, such as theft or vandalism. Collision coverage, on the other hand, can assist with repair or replacement costs for your commercial vehicle in case of accidents.

Finally, consulting with an experienced insurance agent who specializes in commercial auto insurance in California can be invaluable. They can guide you through the process of selecting the right coverage for your specific needs, ensuring that you have adequate protection without overpaying for unnecessary features.

By understanding the insurance requirements, considering additional coverage options, and seeking professional advice, you can navigate the world of commercial auto insurance in California with confidence and protect your business assets on the road.