Home is where the heart is, and it’s precisely why safeguarding your haven is of utmost importance. We invest so much time, effort, and money into creating a cozy and secure space that we can call our own. However, accidents or unexpected events can pose a threat to our beloved abode. That’s where home insurance comes into play, acting as a shield to protect what matters most.

Home insurance, also known as homeowner’s insurance or property insurance, offers financial coverage for your residence, ensuring peace of mind in times of crisis. Whether you own a house, apartment, or condo, having a comprehensive insurance policy can make all the difference. It serves as a safety net against various risks, including damage to the structure, loss of personal belongings, and even liability for accidents that occur on your property.

One key aspect of home insurance is protecting your investment in case of unforeseen mishaps. Accidental fires, theft, vandalism, or natural disasters like storms or earthquakes can cause significant property damage. Having comprehensive coverage enables you to rebuild or repair your home, making sure that you won’t bear the financial burden alone. Additionally, insuring your home can also include coverage for detached structures, such as garages or sheds, ensuring that all aspects of your property are safeguarded.

In addition to property coverage, home insurance often includes liability coverage. This means that if someone is injured on your property, the insurance can help cover medical expenses and legal fees if a lawsuit arises. From slips and falls to more serious incidents, liability coverage ensures that you’re protected against potential financial consequences. Whether you’re hosting a gathering, welcoming guests, or simply going about your daily routine, having this safety net can provide peace of mind knowing you’re covered.

When exploring home insurance options, it’s crucial to understand the different types of coverage available. Some policies may provide coverage for specific hazards, such as fire or theft, while others offer more comprehensive protection. Consulting with insurance providers can help you identify the coverage that best suits your needs.

Remember, your home is more than just four walls and a roof; it’s your sanctuary. Protecting it with home insurance ensures that you can weather any storm, both literally and figuratively. So take the necessary steps to secure your haven and embrace the peace of mind that comes from knowing you’ve taken the right measures to protect your home sweet home.

Understanding Home Insurance

When it comes to protecting your haven, home insurance is an essential investment. Accidents and unforeseen events can happen, causing damage to your house and belongings. Home insurance provides a safety net, giving you peace of mind and financial protection in case the unexpected occurs.

Home Insurance Colorado

One important aspect of home insurance is coverage for property damage. Whether it’s from a fire, severe weather, or vandalism, your home and its contents can sustain significant damage. Home insurance helps cover the costs of repairs or replacement, ensuring that you can restore your property to its former state.

Another key element of home insurance is liability coverage. Accidents can happen, and if someone is injured on your property, you may be held responsible. Liability coverage helps protect you in such situations, covering medical expenses or legal fees if necessary. It’s essential to have this coverage to safeguard your financial well-being and maintain peace of mind.

Additionally, home insurance can provide coverage for loss of personal possessions. If your belongings are stolen or damaged, whether at home or away, your policy can help reimburse you for the value of those items. This coverage extends to a wide range of personal belongings, from furniture and electronics to clothing and jewelry.

In conclusion, home insurance is an indispensable safeguard for homeowners. It offers protection against property damage, liability claims, and loss of personal possessions. By understanding the different aspects of home insurance, you can ensure that your haven remains secure, no matter what unexpected events may arise.

The Importance of Workers Comp Insurance

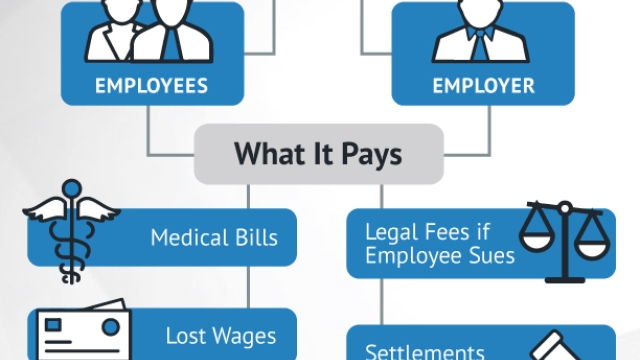

Workers Comp Insurance is an essential safeguard for both employers and employees. This specialized insurance coverage provides financial protection in case any of your workers incur job-related injuries or illnesses. Without it, businesses face the risk of significant financial liabilities and potential legal consequences.

By having Workers Comp Insurance in place, employers demonstrate their commitment to the well-being of their workforce. This coverage ensures that medical expenses, rehabilitation costs, and lost wages resulting from work-related incidents are properly covered. It provides peace of mind to employees, letting them know that they will be taken care of in the event of an unfortunate accident or injury.

Moreover, Workers Comp Insurance plays a central role in maintaining a harmonious workplace environment. Employees feel valued and respected when they know their employer is prepared to support them during difficult times. This insurance coverage promotes a culture of safety and accountability, encouraging both employers and employees to prioritize preventive measures and adhere to best practices.

In summary, Workers Comp Insurance is not only a legal requirement in many jurisdictions, but also a vital protection for both employers and employees. It ensures financial security for workers who have suffered work-related injuries or illnesses, while also safeguarding businesses from potential financial ruin. Investing in this insurance coverage is a smart and responsible decision that fosters a safe and supportive workplace environment.

General Liability Insurance and Contractor Insurance

General liability insurance is a crucial coverage option for homeowners to consider when protecting their properties. This type of insurance provides financial protection against third-party claims for bodily injury, property damage, or personal injury that may occur on your property. Whether you’re a homeowner or a contractor working on someone else’s property, having general liability insurance can give you peace of mind and protect you from potential legal liabilities.

Contractor insurance is specifically designed to cover contractors and their businesses. It includes general liability insurance, as well as additional coverages such as workers’ compensation insurance and commercial auto insurance. This comprehensive insurance package is essential for contractors as it safeguards them from various risks and potential lawsuits that may arise during construction or remodeling projects.

By having general liability insurance in place, homeowners can ensure that they are protected in case of accidents or injuries that occur on their property. For example, if a visitor slips and falls on your driveway or patio, general liability insurance can cover the medical expenses and any resulting legal claims. Similarly, contractor insurance provides contractors with the necessary coverage to protect them from liability claims related to their work, such as property damage caused by their tools or equipment.

In addition to covering bodily injury and property damage, general liability and contractor insurance may also include coverage for advertising injuries, such as copyright infringement or libel accusations. This is particularly important for contractors who rely on advertising their services to attract customers. By having the right insurance coverage in place, contractors can focus on their work while knowing that they are protected against potential legal and financial risks.

Overall, both general liability insurance and contractor insurance play a crucial role in protecting homeowners and contractors from the inherent risks in their respective domains. As a homeowner, it is essential to have general liability insurance coverage to safeguard your property and finances against unforeseen accidents. Contractors, on the other hand, must have contractor insurance to protect themselves, their businesses, and their clients from potential liabilities that may arise during construction projects.