Workers Comp Insurance is a crucial aspect of any business, providing protection and support for both employers and employees in the event of work-related accidents or illnesses. It is an insurance policy that not only safeguards the worker’s rights and well-being but also shields employers from potential legal and financial liabilities.

Home Insurance and General Liability Insurance are essential policies for homeowners and businesses, respectively, offering coverage for property damage, personal injuries, and liability claims. While these insurances are crucial, they are distinct from Workers Comp Insurance, as they primarily focus on different aspects of protection.

Contractor Insurance, on the other hand, shares similarities with Workers Comp Insurance, especially in the context of construction and contracting businesses. It provides coverage for contractors and subcontractors, protecting them from the risks and hazards common in their line of work.

In this comprehensive guide, we will delve into the intricacies of Workers Comp Insurance, exploring its importance, coverage, and benefits for both employers and employees. From understanding the legal obligations surrounding workers compensation to exploring the factors that influence premium rates, we aim to equip you with the knowledge and insights you need to make informed decisions regarding this vital insurance policy.

So, whether you are an employer looking to protect your workforce or an employee seeking to understand your rights and entitlements, join us in unraveling the complexities of Workers Comp Insurance and discover everything you need to know to ensure a secure and safe working environment for all.

1. Understanding Workers Comp Insurance

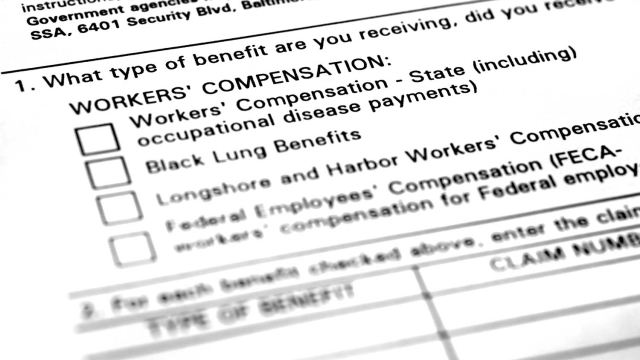

Workers Comp Insurance is a type of insurance coverage that provides protection for both employees and employers in the event of work-related injuries or illnesses. It is designed to cover medical expenses, lost wages, and rehabilitation costs for injured workers. The main purpose of Workers Comp Insurance is to ensure that employees receive the necessary care and financial support while protecting employers from potential lawsuits.

In many countries, including the United States, Workers Comp Insurance is mandatory for businesses that have employees. It is an essential part of managing the risks associated with operating a business, as accidents and injuries can happen even in the safest work environments. By having Workers Comp Insurance, employers can fulfill their legal obligations and provide a safety net for their employees.

Workers Comp Insurance differs from other forms of insurance such as Home Insurance, General Liability Insurance, and Contractor Insurance. While those types of insurance cover property damage and liability claims, Workers Comp Insurance specifically focuses on work-related injuries and illnesses. It is important for employers to understand the unique coverage provided by Workers Comp Insurance and ensure compliance with relevant laws and regulations.

Overall, Workers Comp Insurance plays a crucial role in safeguarding the well-being of employees and providing financial protection for employers. It is essential for businesses to have a comprehensive understanding of Workers Comp Insurance to navigate the complexities of workplace risk management effectively. By understanding the key principles and benefits of Workers Comp Insurance, both employers and employees can be better prepared for any unforeseen circumstances that may arise in the workplace.

2. Key Differences: Home Insurance, General Liability Insurance, and Contractor Insurance

When it comes to insurance, understanding the distinctions between different types of coverage is crucial. Below, we will discuss the key differences between Home Insurance, General Liability Insurance, and Contractor Insurance.

Home Insurance: Home Insurance is designed to protect homeowners from various risks that might affect their property. This type of insurance generally covers damage caused by perils such as fires, natural disasters, theft, and vandalism. It also provides coverage for personal belongings within the home and liability protection in case someone gets injured on the property. However, it’s important to note that Home Insurance typically does not include coverage for injuries sustained by workers while on the job.

General Liability Insurance: General Liability Insurance is a type of coverage that protects businesses against claims of bodily injury, property damage, and personal injury. It provides financial protection if someone sues your business for negligence or accidents that occurred on your premises. However, similar to Home Insurance, General Liability Insurance usually does not cover work-related injuries to employees.

Contractor Insurance: Contractor Insurance is specifically tailored for contractors and often includes coverage for both property and liability. This type of insurance is vital for contractors as it protects against potential lawsuits resulting from property damage, accidents, or injuries that might occur during the course of their work. Unlike Home Insurance and General Liability Insurance, Contractor Insurance generally covers workers’ compensation, ensuring that employees injured on the job receive the necessary medical care and compensation.

By understanding these key differences between Home Insurance, General Liability Insurance, and Contractor Insurance, you can make informed decisions about the type of coverage that best suits your needs. It’s essential to assess your specific risks and consult with an insurance professional to ensure you have the appropriate insurance in place to protect yourself and your business.

3. Tips for Selecting the Right Workers Comp Insurance Policy

When it comes to selecting the right workers comp insurance policy, there are a few key tips to keep in mind.

Workers Comp Insurance ColoradoAssess your specific needs: Before diving into the world of workers comp insurance, it’s important to assess your specific needs. Take a close look at your industry, the nature of your work, and the potential risks involved. This will help you determine the level of coverage you require and any additional endorsements or specific policy features that may be necessary for your business.

Shop around for quotes: As with any insurance policy, shopping around for quotes is a good practice. Take the time to reach out to multiple insurance providers and request quotes for workers comp insurance. This will allow you to compare prices, coverage options, and the reputation of different insurance companies. Remember, going for the cheapest option may not always be the best decision, so make sure to consider the overall value and service offered.

Understand policy exclusions and limitations: It’s crucial to thoroughly understand the exclusions and limitations of any workers comp insurance policy you are considering. Different policies may have different coverage limits, waiting periods, and exclusions for certain types of injuries or illnesses. Make sure to review these details carefully to ensure that the policy you choose aligns with your specific needs and provides adequate coverage for potential claims.

By following these tips, you can confidently select the right workers comp insurance policy that offers the right level of protection for your business and employees.